British banking giant Barclays said Wednesday that net profit tumbled 42 percent in the first quarter, hit by the economic shock sparked by the deadly novel coronavirus.

Earnings after taxation slumped to £605 million ($754 million, 558 million euros) in the three months to the end of March compared with £1.04 billion a year earlier, Barclays said in a results statement.

The lender added it will take a £2.1-billion impairment charge on the overall impact of the devastating COVID-19 pandemic, but reassured over its "robust" position.

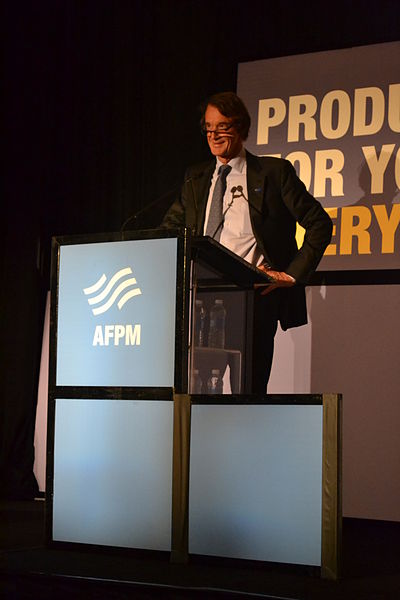

"Despite the macroeconomic downturn caused by the COVID-19 pandemic, the group's position remains robust, reflecting our diversified business model."

Staley also stressed that the impairment charge "reflects our initial estimates of the impact of the COVID-19 pandemic" at both its UK retail bank and international investment arm.

The charge included a £300-million hit linked to "the probability of a sustained period of low oil prices" following the recent market crash, Barclays said.

"An event like the COVID-19 pandemic makes everyone focus on what's really important right now," added Staley.

"For us, that means running the bank safely and soundly, helping our customers and clients through the difficulties they face, supporting the UK economy and the communities where we live and work, and taking care of our colleagues around the world."

Barclays noted that the impact of coronavirus has been cushioned by emergency action from the Bank of England and other major central banks, which have together injected enormous amounts of liquidity, and by costly government stimulus measures.

"We welcome the government and Bank of England's business support programmes and have introduced additional measures to back UK companies ourselves. They are now having a real impact," noted Staley.afp